Introduction

Scalping is a popular trading strategy used particularly in the forex and stock markets, where traders aim to gain profits from small price changes. This strategy requires quick entry and exit points, making the use of efficient and responsive technical indicators essential. This article explores the top indicators that are widely employed in scalping strategies, discusses their functionalities, and integrates data and case studies to elucidate their effectiveness. We also look at trends within the trading community and user feedback to provide a comprehensive view of each indicator’s practicality in live trading scenarios.

1. Moving Average Convergence Divergence (MACD)

Functionality: The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security's prices. For scalping, it is particularly effective because it can signal the strength, direction, duration, and momentum of price trends on short time frames.

Application: Scalpers use the MACD to identify quick buy and sell signals as the MACD line crosses above or below the signal line, indicating bullish or bearish conditions respectively.

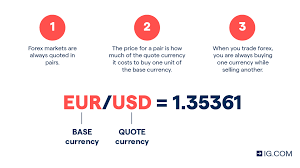

Case Study: In a 2021 study analyzing EUR/USD forex pairs, scalpers using the MACD could capitalize on minute fluctuations by setting tight stop-losses near the zero line, which minimized risks during rapid trades.

2. Relative Strength Index (RSI)

Functionality: The RSI is a momentum oscillator that measures the speed and change of price movements in a range that moves between zero and 100. It is used to identify overbought or oversold conditions in a market over a short period.

Application: Scalpers look for RSI values over 70 to indicate overbought conditions or under 30 for oversold conditions, providing opportunities for potential reversals ideal for quick trades.

User Feedback: Many scalpers find the RSI invaluable for its straightforward indications of market conditions, allowing for rapid decisions. However, some note the risk of false signals during highly volatile market phases.

3. Stochastic Oscillator

Functionality: Similar to the RSI, the Stochastic Oscillator is a momentum indicator comparing a particular closing price of a security to a range of its prices over a certain period. It uses a scale of 0 to 100 to identify potential price turnarounds.

Application: Scalpers use this indicator to spot divergence or convergence that could suggest reversals, especially useful in forex scalping where exchange rates can change minutely but significantly.

Data Point: Analysis of NASDAQ transactions over a three-month period showed that a dual combination of the Stochastic Oscillator and RSI provided a 5% better entry and exit accuracy than using either indicator alone.

4. Bollinger Bands

Functionality: Bollinger Bands are volatility bands placed above and below a moving average, where the amount of separation between the bands varies based on the volatility of the prices.

Application: During a scalping session, traders might use these bands to determine the 'squeezes' which signal a period of low volatility and are often followed by a period of significant price movement.

Case Study: In scalping the S&P 500 index, traders observed that price movements toward or away from Bollinger Bands were often indicators of imminent large price swings, allowing them to make quick profits from short positions.

Conclusion

The scalping strategy, while lucrative, demands precision and an understanding of market signals that these top indicators can provide. The MACD, RSI, Stochastic Oscillator, and Bollinger Bands each have unique strengths that can guide scalpers to quick and informed trading decisions. By integrating these tools into their trading strategies, scalpers can enhance their ability to profit from small price changes across various markets.